People aren’t struggling with economic insecurity because they know less; they’re struggling because of the systemic barriers that exclude them from more income and wealth.

In case you missed it, April is Financial Literacy Month. Here’s hoping it’s the last.

Before I unpack the inherent racism and sexism of financial “literacy,” which—spoiler—is what awaits you in this article, let’s take a moment to reflect on the power of language.

Literacy means “the ability to read or write.” When applied to finance, this concept doesn’t remotely describe the needs of lower-income households. In fact, quite the opposite is true; the persistent, daily crises that predominantly Black and Brown women navigating financial insecurity face have earned them an MBA-equivalent in financial planning, management and strategy. Alas, financial literacy reeks of the bootstraps myth.

But even if we do marginally better and call it financial “education,” our society’s decades-long preoccupation with poor people’s financial acumen has left millions behind. People aren’t struggling with economic insecurity because they know less; they’re struggling because of the systemic barriers that exclude them from more income and wealth.

For example, homeowners weren’t underwater in 2010 because they couldn’t recite the difference between an annual percentage yield and annual percentage rate. If anything, they might have stood a better chance if they understood how mortgage-backed securities and credit default swaps worked (and even those who trafficked them had difficulty).

Bankruptcies didn’t drop between 2010 and 2016 because people learned the difference between a “need” and a “want” and thus started to “live within their means.” Instead, Obamacare went into effect and millions of people were newly protected from large, unexpected health expenses.

Today’s student loan borrowers aren’t deciding between their loans and rent payments because they didn’t comparison shop among lenders. Student loan debt climbed to $1.71 trillion after years of state cutbacks and shifting federal policy.

And today’s 10 million jobless aren’t suffering because they didn’t know to save three months worth of living expenses for emergency savings. Among myriad reasons, people are suffering because policymakers have failed to enact livable wages to ensure that workers can make ends meet.

Financial education is an artifice that impedes the discussion we really need to be having about financial insecurity by reinforcing a deeper narrative about the “undeserving” and “deserving” poor. A close cousin of the “welfare queen,” the undeserving poor opt out of the labor market, can’t be bothered to buckle down to avail themselves of a financial literacy class, and are, in the collective mind’s consciousness: Black and Brown women. The deserving poor, on the other hand, are white, sick, old and—despite their poverty—considered financially “capable.”

These tropes are powerful because they assign blame and preserve power, and ultimately they advance white supremacy.

Lest we write this off as a matter of perspective, multiple meta-analyses of financial education programs have demonstrated time and again that while courses may influence rote knowledge, they have no bearing on action or results. Financial decisions are too complex, are interdependent on too many competing inputs, and the environment is so volatile that we must disabuse ourselves of the idea that financial education will solve all.

Instead, let’s start with what we know to be true about building financial security with low-income people.

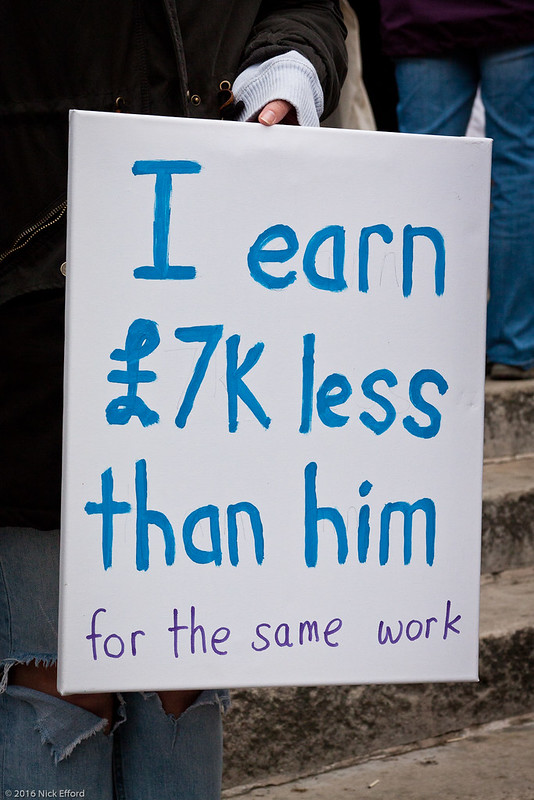

It’s Black and Brown women who navigate financial insecurity the most.

When it comes to demographic disparities in financial security, the writing is on the wall. Regardless of how one assesses wealth, from earnings and savings, to homeownership and retirement, our history of structural racism drives the wealth gap.

Even presently, we witnessed the disproportionate impact of COVID-19 on the financial insecurity of Black and Latinx women specifically, who accounted for nearly all of the 140,000 jobs that the Bureau of Labor Statistics reported lost in December 2020 (the same report that showed employment gains for men and white women). This “she-cession,” as C. Nicole Mason of the Institute for Women’s Policy Research coined, will continue to wreak havoc on the financial security Black and Brown women for years to come.

Now, many are experiencing extended periods of unemployment and facing greater obstacles to re-entering the labor market, assuming there are jobs for them to return to at all. What can financial education really do for these women?

Replace financial education with customer success.

A one-size-fits-all approach to financial education actually deepens inequity along lines of race and gender, rather than level the playing field. For example, my organization has been working with a 68-year-old grandmother to afford a trip to see her grandchildren for the first time in over a year. But first, we helped her reprioritize how she budgets her Social Security retirement benefits. By deprioritizing what the credit score monitoring or credit repair industries advance as blanket objectives, she was able to center her financial goal.

Replacing financial education with true customer service—defined as success when consumers are successful—is a necessary paradigm shift that promotes financial security and equity. Focusing on customer success should be mutually reinforcing, as it bears all the attributes of building long-standing relationships with consumers: bringing a deep curiosity about their needs and challenges; positioning products and services to support their financial lives and goals; and celebrating their successes.

One hallmark of aligning success is to flip the script on consumers as errant or unwitting by championing their hard-earned solutions. Esusu, a Black-led savings and credit building product, does this by drawing on a rich international history of rotational savings clubs, in which members save and borrow together in a form of peer-to-peer banking. By amplifying the solutions that communities create for themselves, Esusu is better positioned to build the financial security of its users.

If we’re serious about consumer safety and protection, let’s legalize it.

Financial education assumes that individuals bear the risk of navigating their own financial lives, despite increasingly perilous terrain. In the past, when we’ve focused on vulnerable borrowers and debtors in distress, we’ve prioritized strict reverse mortgage policies and predatory lending laws. Public policy has a critical role to play in ensuring that consumers and the marketplace are aligned.

Fintech or not, our economy should be built in a way that requires providers of goods and services—at a minimum—to furnish the information and tools that people need to successfully navigate our financial systems. For example, just as the Food and Drug Administration regulates and promotes transparency through nutritional labels, all financial products should be required to plainly feature terms and costs (like a universal Schumer box).

On the other end of the spectrum, greater utility should be made of existing tools, such as the Consumer Financial Protection Bureau’s complaint database. Not only would individuals and families benefit greatly from brighter lines of accountability, but the database itself could be used to reward and further incentivize product makers who advance the financial security of Black and Brown women.

The bottom line is, financial education won’t undo systemic inequity and exclusion. Until we forge the products, practices and policies that advance an equitable economy, we can’t ask the individual to overcome the structural.

You may also like: