Two years into the pandemic, access to COVID vaccines has vastly improved day-to-day life for millions of Americans. But many people are still struggling, especially with the recent Omicron surge. Now, low-income families are in even more precarious positions after the expanded child tax credit (CTC) ended in December, with parents now missing out on two months of payments that many had come to rely upon.

The CTC was one of the most important parts of Biden’s American Rescue Plan, providing parents $3,000 to $3,600 per child during 2021, split up into six monthly payments and a larger lump sum during tax season. For many low-income families, those payments were life-changing, giving them the flexibility to keep up with monthly costs and save for emergencies—like being out of work due to COVID.

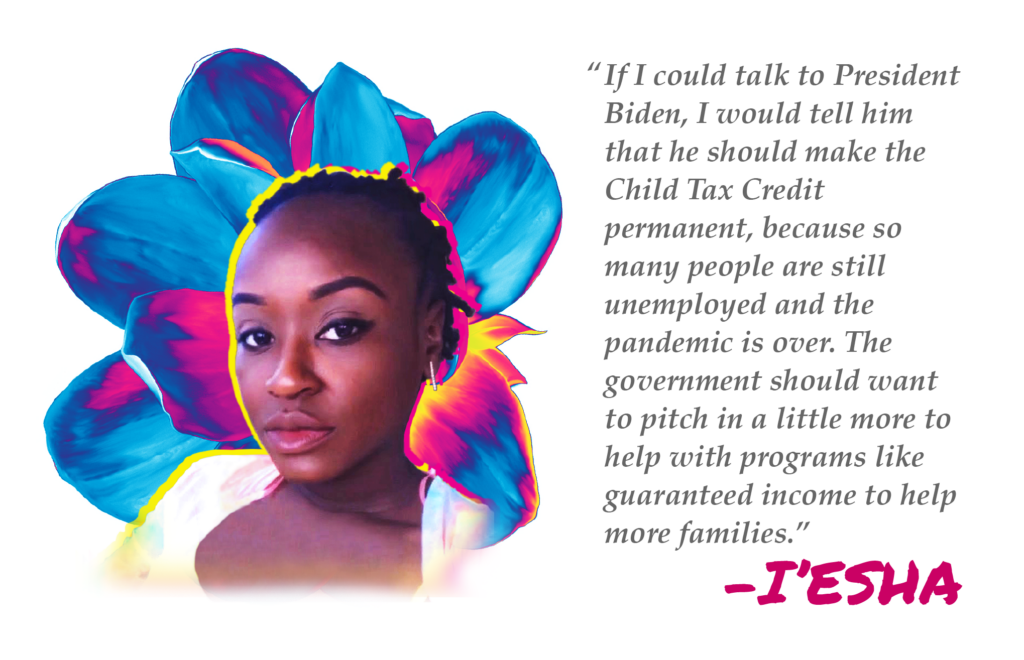

“To get the child tax credit payments has been a huge help,” revealed one low-income mom, I’esha (last name withheld for anonymity). “I was able to use the first payment in July to get prepared and buy my children their school things —there’s so much to get. The clothes, the shoes, the school supplies. I swear that list gets longer every year. If I could talk to President Biden, I would tell him that he should make the child tax credit permanent, because so many people are still unemployed and the pandemic is not over. And people need help even without a pandemic going on.”

The data agrees: In the six months the expanded CTC was active, child poverty was reduced by 30 percent. The payments reached more than 36 million households, keeping 3.7 million children out of poverty in December.

But now, despite the fact that a majority of voters want it to continue, the CTC has expired, thrusting millions of children—disproportionately children of color—back into poverty. House Democrats attempted to extend the credit via the Build Back Better Act (BBB), which would have been an unprecedented investment in low-income families and social infrastructure. But the bill stalled in the Senate, shot down by Senators Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.), as well as every Republican senator.

Although President Biden is attempting to rework and revive the BBB, the months-long CTC lapse will have a dire economic impact on already vulnerable families. As the childhood poverty rate rises—from 12 percent in December to 17 percent in January—Black and Latino families are being hit the hardest by the CTC ending. Experts estimate that the poverty rate for Black and Latino children will jump to over 25 percent.

One reason the CTC was so successful in reducing poverty rates is because it puts unrestricted cash directly into the hands of people who need it most. That flexibility allows families to make the best economic decisions based on their individual circumstances, and gives them the freedom to afford basic needs or invest in long term goals.

But while some politicians worry that unrestricted money policies will discourage low-income people from working to provide for their families, the facts tell a different story: 91 percent of low-income families used their CTC checks to afford basic needs—food, clothing, school supplies, utilities and rent. Other common necessities included transportation costs, childcare and debt payments. Obviously, these parents aren’t squandering the money—they’re using it to build a safety net for their families and support their children’s education.

One low-income Black mom, Sequaya, shared how the CTC impacted her daughter’s life:

“The new child tax credit payments have helped me a lot, especially since I’ve just gone from getting paid every week to having zero income. It’s helped to put shoes on my daughter’s feet and food in the fridge until my SNAP benefits come through. It’s a big relief to wake up and just know, ‘Okay, I’m not going to have to borrow money today because I have that extra help coming in.’ It’s very helpful.”

Roneisha, another low-income mom, used the extra money to keep on top of her bills while she found a well-paying job and welcomed a new baby:

“The struggle with the job hunt makes the child tax credit payments…even more important this year as I work to find a job that pays an even semi-livable wage. It really helped me when I was preparing for my baby to come, I was able to get pretty much everything he needed. At the baby shower all we needed was just a few diapers and things. So that took a lot of stress off to have that money to turn to. It’s all been going to my kids and my bills.”

While the expanded CTC seems to be dead, at least for now, a similar policy is just beginning to enter mainstream awareness: guaranteed income. Economic justice organizations like the Magnolia Mother’s Trust (MMT) argue that a federal guaranteed income program focused on specific marginalized groups would not just help low-income families pay their bills, but also reduce financial stress and set their families up for long-term success.

Just like the CTC, guaranteed income provides low-income families with unrestricted cash, enabling parents to make the best financial decisions for their specific circumstances. MMT is one example of how putting cash directly into the hands of people who need it most gives marginalized people the freedom to support their children and invest in long term goals.

By providing Black mothers living in extreme poverty $1,000 per month for a year, MMT has shown that guaranteed income programs can have huge implications for low-income families and communities.

- The percentage of MMT participants able to pay all their bills without additional support soared from 37 percent to 80 percent during the program.

- After receiving guaranteed payments for a year, 85 percent of the moms had completed their high school education, compared to 63 percent at the beginning of the program.

- MMT mothers were also 20 percent more likely to have children performing at or above grade level, and were 27 percent more likely to seek needed medical care than other moms not receiving guaranteed income.

For many of the MMT moms, the combination of guaranteed income and the CTC allowed them to avoid going into debt and continue working towards larger financial goals, even during periods of unemployment or financial instability caused by the COVID-19 pandemic. For example, Annette wrote:

“Thanks to the new child tax credit expansion coming monthly and the Magnolia Mother’s Trust, I’ve been able to do more for my kids and not have to worry if I can afford a school uniform or school supplies. I’ve also been able to catch up on some bills. If I were able to sit down with our country’s leaders, I would tell them how important a program like the Trust is. It helps low-income women like myself better ourselves. The money has helped me in pursuing a better future for me and my kids and allows me to do things that I wasn’t really able to before—like going back to school.”

And Sherika shared how guaranteed income and the CTC have both been essential in helping keep her family afloat:

“With the Trust on top of the child tax credit that’s been coming monthly, it’s been so necessary for me. One helps me pay my bills; the other helps me put away a little bit for the hard times. If it weren’t for those payments, I wouldn’t have been able to take a little time off to care for my baby. I really don’t know what I would have done. These two things combined have done so much for me and my family; it has just uplifted me a lot and I’m very grateful.”

The expanded CTC ending is a tragic moment for the U.S., sending millions of children back into poverty and undoing some of the progress low-income families were able to make during 2021. But while conservative politicians continue to ignore the pleas of low-income Americans, economic justice advocates are refusing to give up on their goal of supporting marginalized communities.

With the BBB floundering in the Senate, continuing the CTC may be out of reach for now. But the effectiveness of the CTC proves that unrestricted cash policies can keep families out of poverty, paving the way for a federal guaranteed income program to ensure that low-income people can invest in their families without being sucked into crushing cycles of debt.

Up next: